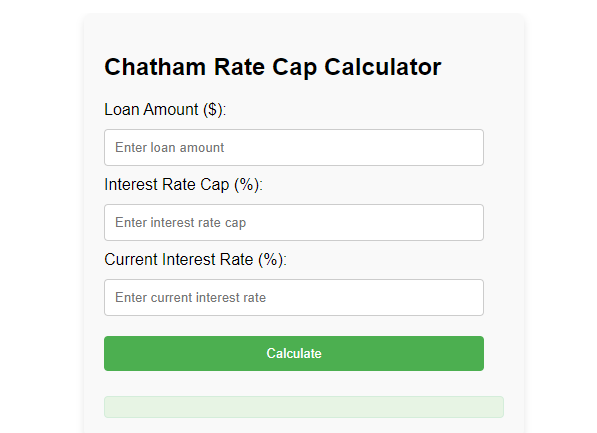

Chatham Rate Cap Calculator

In the ever-fluctuating world of finance, security and foresight can be the difference between success and shortfall. That’s where our Chatham Rate Cap Calculator steps in; it brings both of those critical factors into your hands by empowering you to understand potential changes in your interest payments immediately.

A Vital Tool for Loan Management

Rate caps can be a saving grace for loans subject to variable interest rates, setting a maximum limit on the interest rate climb over a period. The Chatham Rate Cap Calculator is designed to help loan holders and financiers quickly estimate the rate cap values based on their current loans, providing an essential snapshot of their financial obligations.

Accuracy at the Click of a Button

Using the calculator couldn’t be simpler:

- Enter your total loan amount.

- Specify the interest rate cap agreed upon in your financial contract.

- Input the current interest rate.

With just a click, determine whether you will be paying the capped rate or the current rate on your loan. This simple computation could dictate your financial strategy and impact how you manage your capital.

Your Financial Forecast, Defined

Equipped with the knowledge of what your interest payments could look like, you can plan ahead with confidence. The Chatham Rate Cap Calculator isn’t just a tool; it’s a roadmap to better financial health and informed decisions.

Stay Ahead of the Curve

With financial markets in a constant state of evolution, having the Chatham Rate Cap Calculator on yourside equips you with a readiness to react. Implement this potent ally in your financial arsenal today and take control of how interest rate fluctuations affect you.

- Navajo language translator

- 0x7 calculator

- 1.85 Every Minute for a Year Calculator

- 1’s Complement Calculator – Calculate the 1’s Complement of Binary Numbers Online

- 1/8 Mile ET Calculator

- 1/8 th Mile ET-MPH-HP Drag Race Calculator

- 10 Key Calculator

- 10 year loan calculator

- 10.2 talent calculator

- 1099 Estimated Tax Calculator

- 12 Digit Calculator – Online Tool for Accurate Calculations

- 14k Gold Calculator

- 156 Calculators

- 1800s inflation calculator

- 2048

- 4 Patriot Solar Generator – Reliable and Efficient Power Solution

- A1c-Calculator

- Aarakocra Name Generator

- About

- ACFT Calculator – Calculate Army Combat Fitness 2024

- Acuvue MF Calculator | Calculate Your Contact Lens Prescription

- AI Cocktail Name

- Ai Dj Name

- Air Fryer Conversion Calculator

- All-in-One Random Number Generator

- Amazon Business Name

- Amazon Top 100 Discs

- Amortization Calculator

- Ancient Calculator

- Annealing TemperatureBio laboratory

- ap gov score calculator

- Ap Lang Score Calculator

- Area Conversions

- Astro Seek Transit Chart Calculator

- AT&T Price Calculator

- Audiobook Speed Calculator

- Audiobook Speed Calculator

- Auto Loan calculator

- Baluster Calculator

- Basic Calculator – Online Calculator for Simple Math Operations

- Biology

- BJT Emitter Calculator

- black american name generator

- Blog

- BMR Calculator | Calculate Your Basal Metabolic Rate Online

- Board Foot Calculator

- Body Fat Percentage Calculator – Calculate Your Body Fat Percentage Online

- Bra Size Calculator

- Calculate Cleaning Time

- calculating force worksheet

- Calculations with the TI-108SC Style Online Calculator

- car insurance calculator

- Carpet Calculator

- Cash App Generator – Is it Legitimate or a Scam?

- Casio Calculator

- casio-graphing-calculator

- Cis Calculator

- Concrete Calculator

- Contact

- Crossword Clue Calculator

- Curtain Size Calculator

- Data Calculated

- Delighted Nps Calculator

- Desmos Graphing Calculator

- Dice-Roller

- Differential Equation Calculator

- Domain-Whois

- Effortless Scoring: The Mumbai University Percentage Calculator

- Elden Ring Name Generator +100 idea

- Empirical Rule Calculator

- Equity Release

- Extra Time Calculator

- Fraction Calculator – Free Online Tool for Adding, Subtracting, Multiplying, and Dividing Fractions

- Free Chatgpt

- Free Mlp Name Generator

- Free Scientific Calculator Tool

- FREE Ti 84 Calculator Online

- Gas Rate Calculator

- Gas Rate Calculator

- Generation Lighting – Illuminating the Future

- Generation Time

- Goblin Name Generator

- Good Stripper Name Generator

- Google Adwords Price Calculator

- GPA Calculator

- Grade Calculator – Calculate Your Grades Easily Online

- Hardcore Calculator

- Heat Index Calculator

- Height Calculator

- Home

- Home Loan Calculator

- Hourly to salary calculator oregon

- Hours Calculator – Calculate Working Hours Online

- How Much Rent Can I Afford-Rent Affordability Calculator

- Ideal Weight Calculator

- Ideal Weight Calculator

- Inverse Matrix Calculator

- Itt Calculator

- IVF Due Date Calculator

- James Smith Calorie Calculator

- kalkulator wynagrodzeń niemcy

- Keyword Cost Per Click Calculator

- Keyword Golden Ratio

- Kingdom Name Generator

- Laplace Transform Calculator

- Loan Calculator

- Maximize Your Farming Efficiency with Our Acres Per Hour Calculator

- Maze Generator

- Mean, Median, Mode Calculator

- Meilenrechner Lufthansa

- Morse Code Alphabet

- Morse Code Generator

- Morse Code Numbers

- mortgage repayment calculator

- Name Generator

- Navi Name Generator

- New jersey teacher pension calculator

- New NHS Annual Leave Calculator

- NHS Pregnancy Calculator

- Night Cafe AI Art Generator

- Number Generator

- Numbers to Words Converter

- Numerology Wedding Date Calculator

- Online Percentage Calculator – Calculate Percentages Easily and Quickly

- P4G Fusion Calculator

- Percentage Calculator – Calculate Percentages Online

- Pregnancy Calculator

- Privacy Policy

- Quadratic Formula Calculator

- Random Number Generator – Generate Random Numbers Online

- Remaping Calculator The Potential Power And Torque

- Responsive Tip Calculator

- Rodian Name Generator

- Rolex Deepsea Watch Selector Generator

- Rounding Calculator

- SaaS Boilerplates

- Salary Calculator

- School Name Generator

- Screed Calculator

- ShipFast-Ship your startupin days,not weeks

- Sip Calculator

- Snow Day Calculator

- Solar Eclipse:USA Checker

- Spaces to Tabs Converter

- Square Footage Calculator – Calculate Area of a Room or Property Online

- Standard Deviation Calculator

- Steam Key Generator

- Stripper Name Generator

- Subnet Calculator – Free Online Tool for Network Configuration

- Surd Calculator – Simplify Surds Online | Free Tool

- Synthetic Division Calculator

- Tailwind CSS Color Palette Generator

- Tailwind CSS Gradient Generator

- Tailwind CSS Grid Generator

- take home pay calculator

- Tavern Name Generator

- Tax Calculator

- TDEE Calculator

- The Benefits of a 50 Amp Generator for Your Power Needs

- The Essential Chlorine Tablet Calculator

- The Horse Coat Color Calculator!

- The Secret Affairs Of The 3rd Generation Chaebol

- Third Calculate Your Stimulus Payment

- Tiefling Names Generator

- TikTok Ads Cost

- Time Calculator

- Time Duration Calculator

- unitarium time calculator

- Vat Calculator

- Voltage Drop Calculator

- wedding date numerology

- Wedding RSVP Date

- Welder Generator – Powering Your Welding Needs

- Wheel Date Calculator

- X ai Gork Q&A Recommendation Center