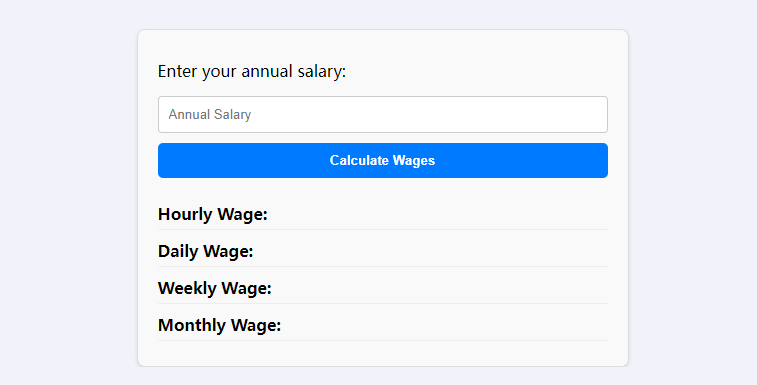

The accompanying article (approx. 800 words) would delve into the importance of understanding your salary structure for financial planning and negotiations. It would outline how the calculator can be a vital tool for converting your annual salary to its equivalent in hourly, daily, weekly, and monthly wages. Furthermore, the article could discuss how this understanding allows for more informed decisions regarding job offers, freelance rates, contract work, and salary discussions.

he payroll calculator converts payroll amounts for one type of period to quantities for a longer or shorter period. It can show payouts once an hour, a day, a week, two weeks, twice a month, a month, a quarter, and a year. The results include unadjusted and adjusted figures to account for vacation days and holidays in the year.

This salary calculator assumes that hourly and daily wages are unadjusted values. All other pay period values are considered values adjusted for holidays and vacation days.

This calculator bases its calculations on the assumption that there are 260 weekdays in a year and 52 working weeks. The unadjusted statistics do not consider days off for vacation or holidays.

Workers receive a salary or compensation from their employer for the time and effort put into the company. In many countries, worker protections include a minimum wage set by the national or local government. Also, professionals might establish Unions in certain firms or sectors to develop standards for working conditions.

Salary

An employee’s salary is a fixed sum of money provided regularly. The amount rarely changes depending on the quantity or quality of the completed work. Specifying the yearly amount of an employee’s wage inside the employment contract is usual. Additional forms of remuneration such as providing goods and services often supplement salaries.

Wage

Several important conceptual distinctions exist between “wage” and “salary.” First, “wage” is applied to compensating an employee based on the total hours worked multiplied by the hourly pay rate. The word “salary” is most commonly linked with annual employee remuneration.

Wage earners are also more likely to be non-exempt. It implies businesses are subject to the government’s overtime wage regulations, which are in place to protect workers. The Fair Labor Standards Act (FLSA), which controls the U.S. labor market, contains these regulations.

Non-exempt workers are often compensated for overtime at a rate of 1.5 times their regular wage for any hours worked after they exceed 40 hours per week. Non-exempt workers may receive double (or, less frequently, triple) their regular pay if required to work during the holidays.

Salaried workers generally are not eligible for these benefits and additional cash compensation, even after working on holidays or over 40 hours a week.

Usually, wage earners have a lower income than non-wage earners. For example, a barista who works at a café may earn a “wage.” In contrast, a professional office worker earns a “salary.” These terms refer to the compensation received for the employee’s job. Salaried occupations have a greater perceived prestige according to society.

Most wages and salaries are paid occasionally, the most common monthly, semi-monthly, biweekly, or weekly. Wage-earners can use this calculator even though it is a Salary Calculator since it can convert sums.

Employee Benefits

The significance of salaries and earnings is undeniable, but not all the financial rewards are paid out in paychecks. Employees earning salaries and sometimes wage-earners may get other types of benefits. They include payroll taxes, health insurance, employer-shared retirement plans, unemployment taxes, paid vacation/vacation days, company discounts, bonuses, etc. There is a lower probability that part-time workers will be eligible for these benefits.

The value of various employee perks, measured based on money, might vary significantly from one situation to another. When choosing a job, it is essential to consider these benefits and the base or salary offered.

Self-employed Contractors

Freelancers who are sole proprietors that offer their wares and services are examples of self-employed contractors. Self-employed contractors often provide hourly, daily, or weekly prices, among other options.

Independent contractors rarely get the advantages traditionally associated with full-time employment, including paid time off, reduced health insurance premiums, or other financial rewards. This consequently increases the potential for higher pay rates.

As a result, they need higher financial compensation than full-time workers. In the real world, however, rates are determined by many factors. It is not uncommon for contractors to receive lower compensation.